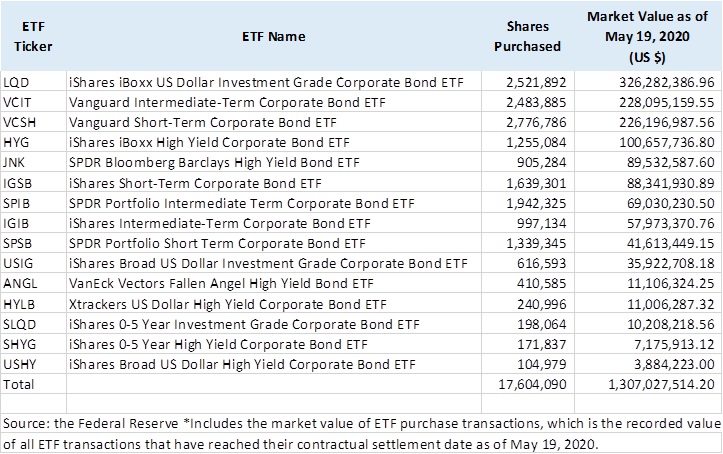

News - A look inside the Fed's $1.307 billion ETF allocation – 7 iShares ETFs account for 48% of the assets

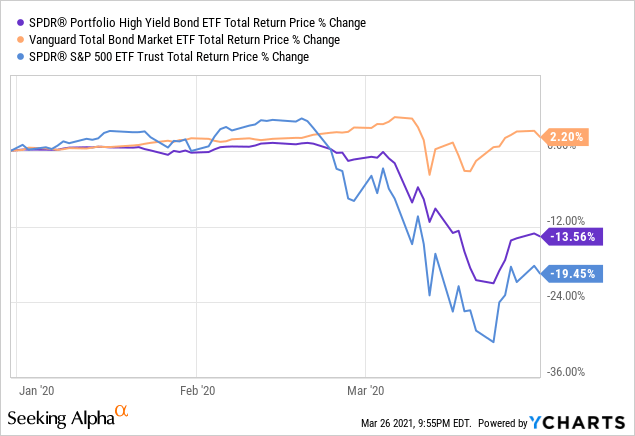

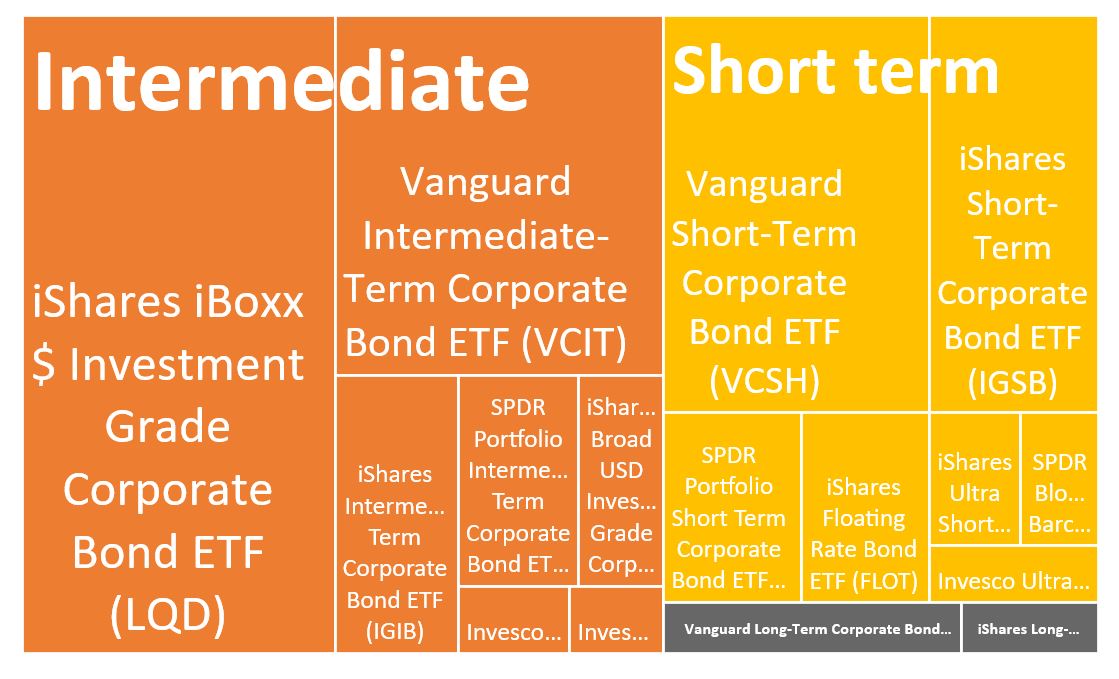

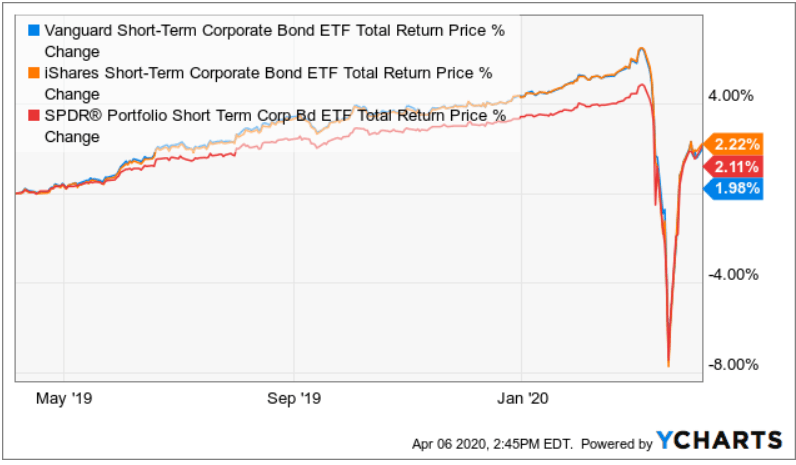

VCSH: 2.96% Yielding ETF, Supported By Fed's Decision To Protect Corporate Debt Market (NASDAQ:VCSH) | Seeking Alpha

SPLB Institutional Ownership and Shareholders - SPDR(R) Portfolio Long Term Corporate Bond ETF (NYSE) Stock

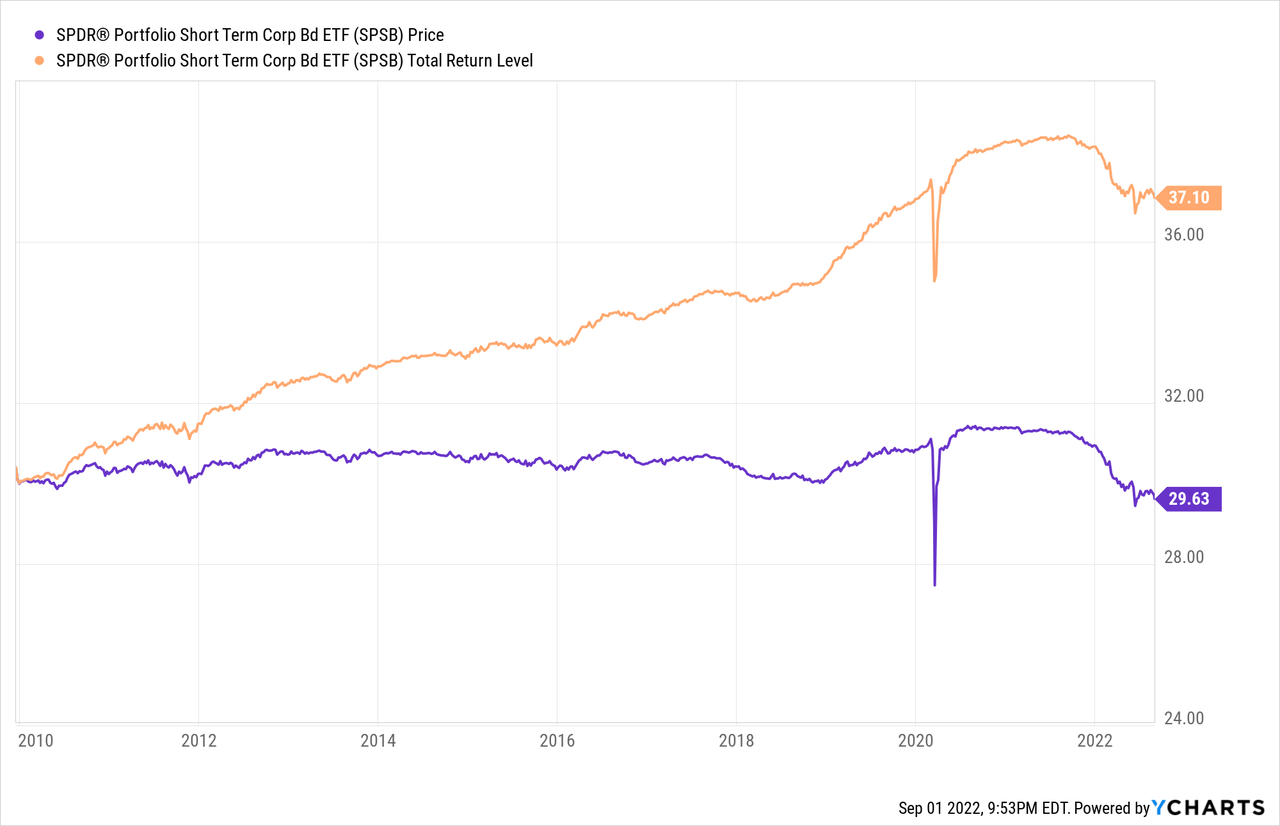

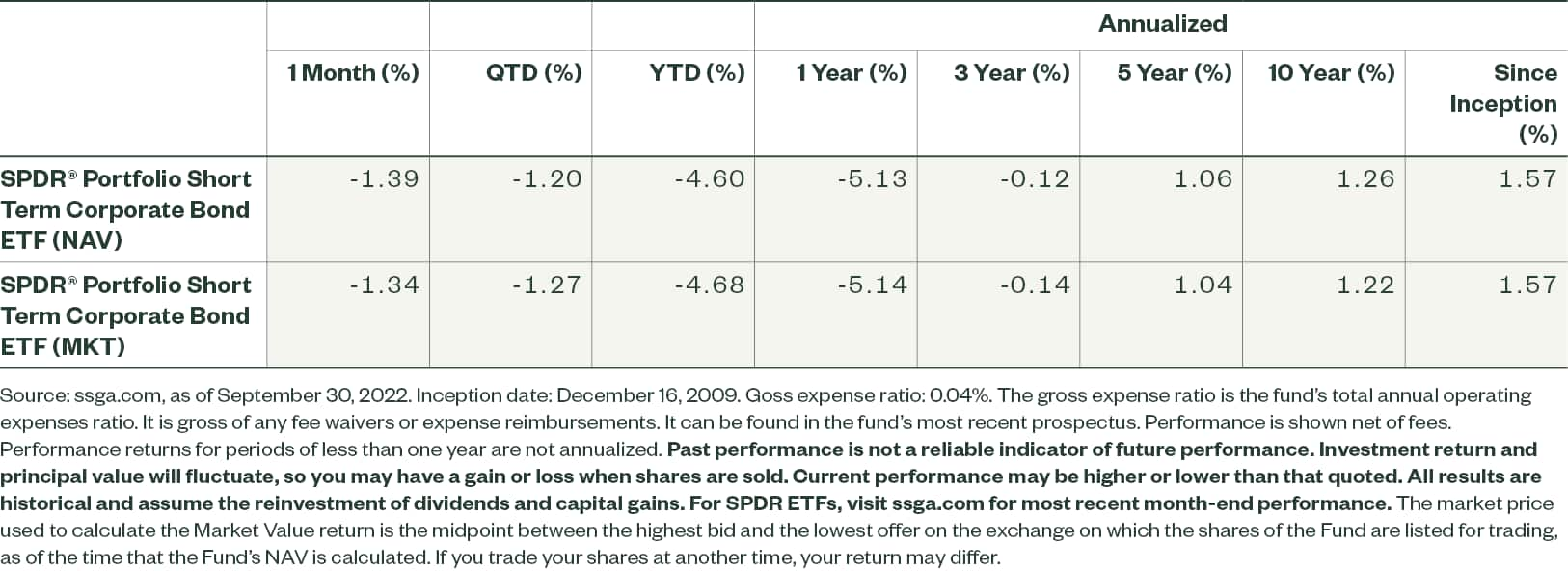

SPSB Institutional Ownership and Shareholders - SPDR(R) Portfolio Short Term Corporate Bond ETF (NYSE) Stock

SPSB Institutional Ownership and Shareholders - SPDR(R) Portfolio Short Term Corporate Bond ETF (NYSE) Stock

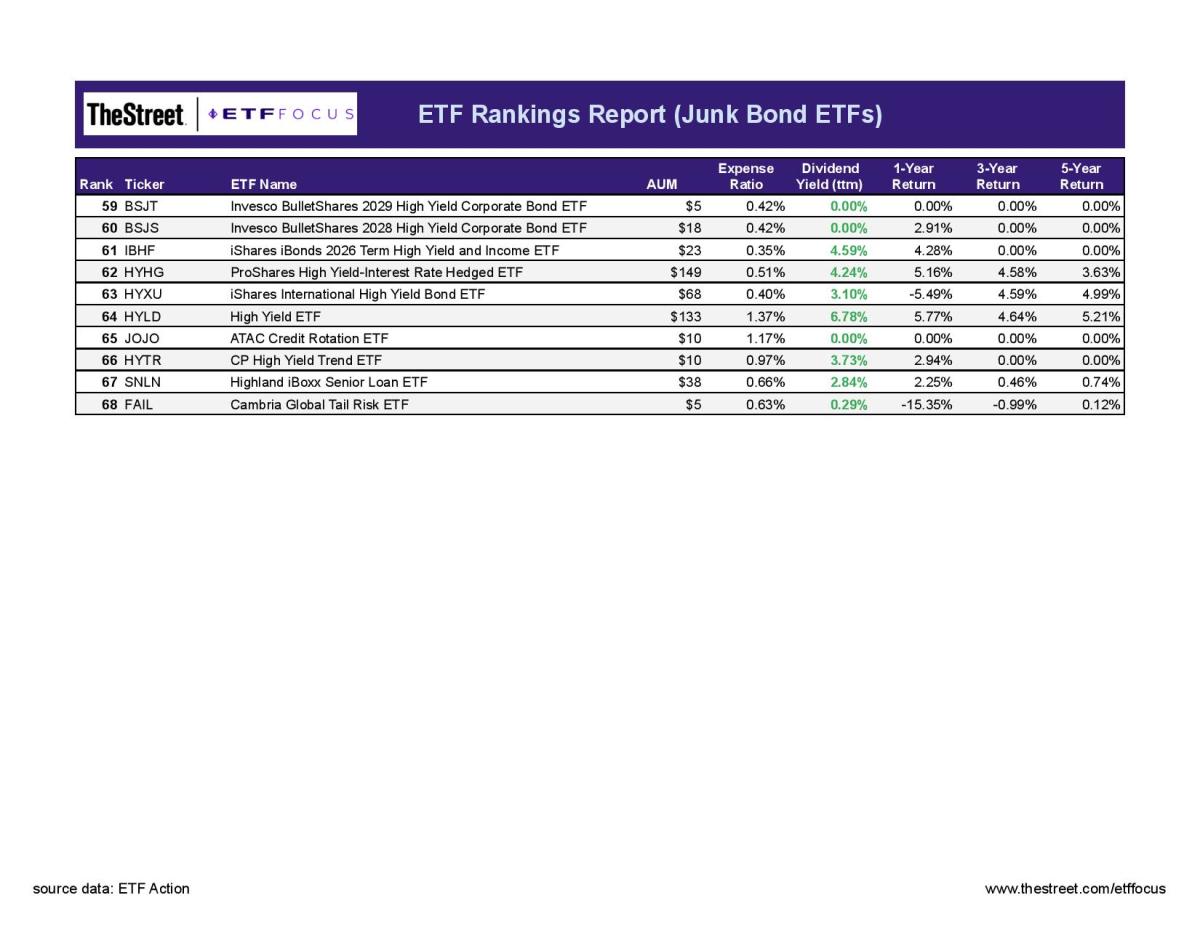

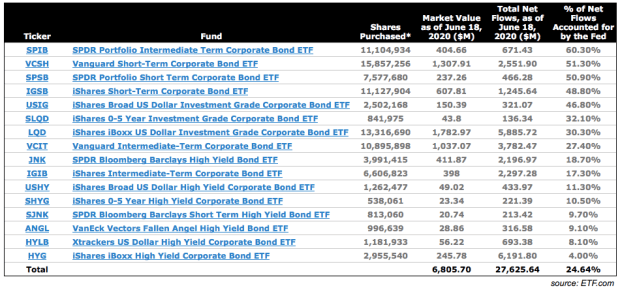

Fed Purchases Account For More Than 50% Of New Cash In Some Bond ETFs - ETF Focus on TheStreet: ETF research and Trade Ideas

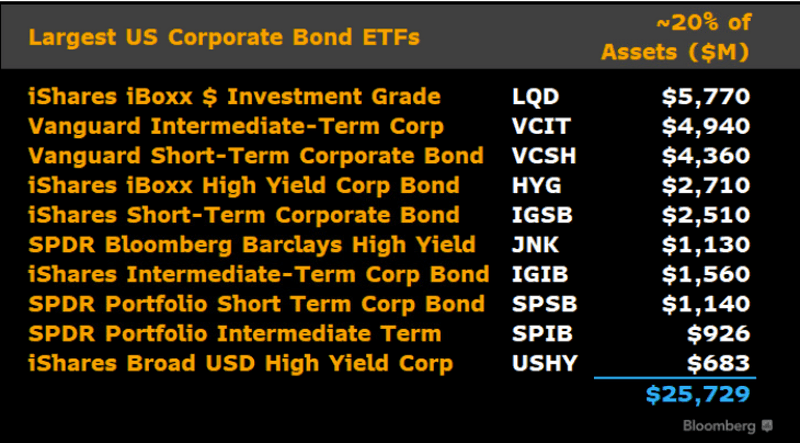

Fallen-angel bond ETFs could have been Fed's glass slipper | Insights | Bloomberg Professional Services

:max_bytes(150000):strip_icc()/SPDR_ETFs_GettyImages-12042276212-813ec6c6a86e4da6ba2c1ee528113bc8.jpg)